AI STRATEGY

M&A

GROWTH

ARIS JANSONS

Buying and building businesses that matter. If you’re serious about selling, I’m the person you want across the table.

AI STRATEGY

M&A

GROWTH

ARIS JANSONS

Buying and building businesses that matter. If you’re serious about selling, I’m the person you want across the table.

Positioning strip

I’m an operator first, acquirer second – I’ve taken a niche service group to eight‑figure revenue and now do the same as a focused portfolio.

AIPRENEUR

OPERATOR

ACQUIRER

I buy and build profitable service businesses in Europe, then wire AI and systems into them so they scale without drama.

I’m an operator first, acquirer second – I’ve taken a niche service group to eight‑figure revenue and now do the same as a focused portfolio.

Selling or buying a company isn’t just numbers. It’s identity, timing, family, energy. I pay attention to all of it. I’ve made deals that changed my life and deals that hurt but taught me more than any book ever could. The good ones built momentum. The bad ones built judgement. I use both when I sit down with an owner. I care about what actually works in business right now – the strategies, systems and structures that still hold when the market stops being polite. I’ve seen one thing over and over: if you feed your mind the same ideas as everyone else, you end up living the same life as everyone else. Different inputs, different decisions, different outcomes.

Henry Ford put it simply: “Whether you think you can, or you think you can’t – you’re right.” I agree with the first part. Decide you can, then do the work that proves you right.

Strategy & life

Henry Ford put it simply: “Whether you think you can, or you think you can’t – you’re right.” I agree with the first part. Decide you can, then do the work that proves you right.

Selling or buying a company isn’t just numbers. It’s identity, timing, family, energy. I pay attention to all of it. I’ve made deals that changed my life and deals that hurt but taught me more than any book ever could. The good ones built momentum. The bad ones built judgement. I use both when I sit down with an owner. I care about what actually works in business right now – the strategies, systems and structures that still hold when the market stops being polite. I’ve seen one thing over and over: if you feed your mind the same ideas as everyone else, you end up living the same life as everyone else. Different inputs, different decisions, different outcomes.

Henry Ford put it simply: “Whether you think you can, or you think you can’t – you’re right.” I agree with the first part. Decide you can, then do the work that proves you right.

Strategy & life

Henry Ford put it simply: “Whether you think you can, or you think you can’t – you’re right.” I agree with the first part. Decide you can, then do the work that proves you right.

Selling or buying a company isn’t just numbers. It’s identity, timing, family, energy. I pay attention to all of it. I’ve made deals that changed my life and deals that hurt but taught me more than any book ever could. The good ones built momentum. The bad ones built judgement. I use both when I sit down with an owner. I care about what actually works in business right now – the strategies, systems and structures that still hold when the market stops being polite. I’ve seen one thing over and over: if you feed your mind the same ideas as everyone else, you end up living the same life as everyone else. Different inputs, different decisions, different outcomes.

Henry Ford put it simply: “Whether you think you can, or you think you can’t – you’re right.” I agree with the first part. Decide you can, then do the work that proves you right.

Strategy & life

Henry Ford put it simply: “Whether you think you can, or you think you can’t – you’re right.” I agree with the first part. Decide you can, then do the work that proves you right.

For owners thinking about an exit

If you’re quietly exploring a sale, you don’t just need a buyer. You need someone who understands what it took to build what you have and who is prepared to treat it with that level of respect.

I’m interested in partnership, not just transactions. Sometimes that means a full exit. Sometimes it means staying involved for a period or co‑creating the next phase together. The structure follows what makes sense for you, your people and the business.

Clean exits

Transitions that protect your team, your customers and your name.

Clean exits

Transitions that protect your team, your customers and your name.

Clean exits

Transitions that protect your team, your customers and your name.

Flexible structures

Embedding AI agents and automation inside operations to increase margins and predictability.

Flexible structures

Embedding AI agents and automation inside operations to increase margins and predictability.

Flexible structures

Embedding AI agents and automation inside operations to increase margins and predictability.

Scale Systems

Earn‑outs, phased exits or retainers built around your real life, not just a spreadsheet.

Scale Systems

Earn‑outs, phased exits or retainers built around your real life, not just a spreadsheet.

Scale Systems

Earn‑outs, phased exits or retainers built around your real life, not just a spreadsheet.

Quiet, managed process

No circus, no unnecessary noise. Calm, private and handled like adults.

Quiet, managed process

No circus, no unnecessary noise. Calm, private and handled like adults.

Quiet, managed process

No circus, no unnecessary noise. Calm, private and handled like adults.

Why I’m a different kind of buyer

0-001

Operator first, acquirer second

I’ve taken a niche Swedish service group from local player to nationwide operator serving clients from around the world, reaching eight‑figure annual revenue with triple‑digit growth and two competitor acquisitions. I know what it means when every decision shows up in payroll, suppliers and client retention. That’s the lens I bring when we sit on the same side of the table.

0-002

AI as a quiet edge

My edge is how I use AI inside real businesses – not as a slogan, but as part of the operating system. I design and implement agents, automated workflows and data‑driven sales systems that increase revenue, remove friction and make performance more predictable. For the right company, that turns into stronger margins, clearer numbers and a business that’s easier to own – and, if we choose that path together, easier to sell in the future.

AI

Why I’m a different kind of buyer

0-001

Operator first, acquirer second

I’ve taken a niche Swedish service group from local player to nationwide operator serving clients from around the world, reaching eight‑figure annual revenue with triple‑digit growth and two competitor acquisitions. I know what it means when every decision shows up in payroll, suppliers and client retention. That’s the lens I bring when we sit on the same side of the table.

0-002

AI

AI as a quiet edge

My edge is how I use AI inside real businesses – not as a slogan, but as part of the operating system. I design and implement agents, automated workflows and data‑driven sales systems that increase revenue, remove friction and make performance more predictable. For the right company, that turns into stronger margins, clearer numbers and a business that’s easier to own – and, if we choose that path together, easier to sell in the future.

Why I’m a different kind of buyer

0-001

Operator first, acquirer second

I’ve taken a niche Swedish service group from local player to nationwide operator serving clients from around the world, reaching eight‑figure annual revenue with triple‑digit growth and two competitor acquisitions. I know what it means when every decision shows up in payroll, suppliers and client retention. That’s the lens I bring when we sit on the same side of the table.

0-002

AI as a quiet edge

My edge is how I use AI inside real businesses – not as a slogan, but as part of the operating system. I design and implement agents, automated workflows and data‑driven sales systems that increase revenue, remove friction and make performance more predictable. For the right company, that turns into stronger margins, clearer numbers and a business that’s easier to own – and, if we choose that path together, easier to sell in the future.

AI

Serious capital, serious experience

Acquisitions at this level don’t happen alone. I work alongside a small group of investors and operators who’ve closed more than 100 M&A transactions across three continents – from mid‑market buyouts to nine‑figure exits.

This isn’t theoretical capital. These are people who’ve sat across the table hundreds of times, structured deals through recessions and boom cycles, and built real wealth by buying and building companies that matter. When we evaluate an opportunity together, you’re not talking to someone playing with house money. You’re talking to people who have already done what you’re considering – and who understand how to make it work in the real world.

This isn’t theoretical capital. These are people who’ve sat across the table hundreds of times, structured deals through recessions and boom cycles, and built real wealth by buying and building companies that matter. When we evaluate an opportunity together, you’re not talking to someone playing with house money. You’re talking to people who have already done what you’re considering – and who understand how to make it work in the real world.

The path we’re building

Most people think in single steps: build a company, maybe sell it, maybe start again. I’m building something different – a deliberate portfolio that compounds over time. We start with fundamentals: acquire profitable service businesses with roughly €1–10M in revenue that are operationally sound but underutilized. Then we apply leverage – embed AI, tighten operations, deepen sales, expand what already works. Companies doing €3M move to €10M. €10M turns into €30M. As we scale and repeat, capital recycles back into the next deal. The goal is a portfolio that crosses €100M in combined revenue within the coming years, with the resilience to handle both growth and shocks. From there, the real options open up – consolidation, institutional capital, or a strategic exit that changes the picture for everyone involved.

From €1-10M to €50-100M and Billion Exit Ahead

The path we’re building

Most people think in single steps: build a company, maybe sell it, maybe start again. I’m building something different – a deliberate portfolio that compounds over time. We start with fundamentals: acquire profitable service businesses with roughly €1–10M in revenue that are operationally sound but underutilized. Then we apply leverage – embed AI, tighten operations, deepen sales, expand what already works. Companies doing €3M move to €10M. €10M turns into €30M. As we scale and repeat, capital recycles back into the next deal. The goal is a portfolio that crosses €100M in combined revenue within the coming years, with the resilience to handle both growth and shocks. From there, the real options open up – consolidation, institutional capital, or a strategic exit that changes the picture for everyone involved.

From €1-10M to €50-100M and Billion Exit Ahead

The path we’re building

Most people think in single steps: build a company, maybe sell it, maybe start again. I’m building something different – a deliberate portfolio that compounds over time. We start with fundamentals: acquire profitable service businesses with roughly €1–10M in revenue that are operationally sound but underutilized. Then we apply leverage – embed AI, tighten operations, deepen sales, expand what already works. Companies doing €3M move to €10M. €10M turns into €30M. As we scale and repeat, capital recycles back into the next deal. The goal is a portfolio that crosses €100M in combined revenue within the coming years, with the resilience to handle both growth and shocks. From there, the real options open up – consolidation, institutional capital, or a strategic exit that changes the picture for everyone involved.

From €1-10M to €50-100M and Billion Exit Ahead

What I actually look for

I’d rather do a few great deals than a pile of average ones. I’m selective on purpose.

0-001

Understand

Profitable, with real customers and recurring or repeat revenue.

0-001

Understand

Profitable, with real customers and recurring or repeat revenue.

0-001

Understand

Profitable, with real customers and recurring or repeat revenue.

0-002

Evaluate

B2B or service‑heavy, where relationships and operations really matter.

0-002

Evaluate

B2B or service‑heavy, where relationships and operations really matter.

0-002

Evaluate

B2B or service‑heavy, where relationships and operations really matter.

0-003

Structure

Based in Europe, or structured so it can be operated from Europe.

0-003

Structure

Based in Europe, or structured so it can be operated from Europe.

0-003

Structure

Based in Europe, or structured so it can be operated from Europe.

0-003

Structure

Clean exit, phased transition, or tailored hybrid.

0-006

Structure

Numbers that still make sense when you ask the second and third question.

0-004

Execute

Led by an owner who is honest, direct and cares about their people.

0-004

Execute

Led by an owner who is honest, direct and cares about their people.

0-004

Execute

Led by an owner who is honest, direct and cares about their people.

0-005

Execute

Solid fundamentals with underused potential in systems, AI or sales.

0-005

Execute

Solid fundamentals with underused potential in systems, AI or sales.

0-005

Execute

Solid fundamentals with underused potential in systems, AI or sales.

0-006

rutuyt4uh

Numbers that still make sense when you ask the second and third question.

0-006

rutuyt4uh

Numbers that still make sense when you ask the second and third question.

How I buy companies

A disciplined, four‑step process for turning quiet conversations into aligned deals.

Your message goes directly to me. It isn’t shared with anyone else.

Step 1

Quiet conversation

We talk privately about your business, your numbers and what you actually want from a sale.

Step 2

Calm analysis

I review the fundamentals, not just the headline: margins, clients, concentration, systems, risks.

Step 3

Aligned structure

If it’s a fit, we explore deal structures that work for both of us – from a clean exit to a phased transition.

Step 4

Managed transition

Once agreed, we run the process professionally and quietly, so your people and clients are protected.

How I buy companies

A disciplined, four‑step process for turning quiet conversations into aligned deals.

Your message goes directly to me. It isn’t shared with anyone else.

Step 1

Quiet conversation

We talk privately about your business, your numbers and what you actually want from a sale.

Step 2

Calm analysis

I review the fundamentals, not just the headline: margins, clients, concentration, systems, risks.

Step 3

Aligned structure

If it’s a fit, we explore deal structures that work for both of us – from a clean exit to a phased transition.

Step 4

Managed transition

Once agreed, we run the process professionally and quietly, so your people and clients are protected.

How I buy companies

A disciplined, four‑step process for turning quiet conversations into aligned deals.

Your message goes directly to me. It isn’t shared with anyone else.

Step 1

Quiet conversation

We talk privately about your business, your numbers and what you actually want from a sale.

Step 2

Calm analysis

I review the fundamentals, not just the headline: margins, clients, concentration, systems, risks.

Step 3

Aligned structure

If it’s a fit, we explore deal structures that work for both of us – from a clean exit to a phased transition.

Step 4

Managed transition

Once agreed, we run the process professionally and quietly, so your people and clients are protected.

About Aris

Latvian by origin, European by mindset. Nearly two decades in B2B sales, team leadership and business development across technology, services and real estate. I’ve grown teams, managed operations and driven the kind of deals that move a company forward.

Over the last five years, I helped scale a niche Swedish service group into a nationwide business serving clients from around the world, taking it to eight‑figure annual revenue with triple‑digit growth and two competitor acquisitions.

Today my work sits where AI, acquisitions and strategy meet. I’m as comfortable in the boardroom as I am close to the operation, and I care about how things actually run – not just how they look in a slide deck. I speak founder more than I speak consultant.

Today my work sits where AI, acquisitions and strategy meet. I’m as comfortable in the boardroom as I am close to the operation, and I care about how things actually run – not just how they look in a slide deck. I speak founder more than I speak consultant.

How it feels to work with me

Quiet, direct conversations – no theatre, no inflated promises.

Quiet, direct conversations – no theatre, no inflated promises.

Thoughtful questions, clear answers and respect for your time.

Thoughtful questions, clear answers and respect for your time.

A long‑term view that values your legacy as much as the numbers.

A long‑term view that values your legacy as much as the numbers.

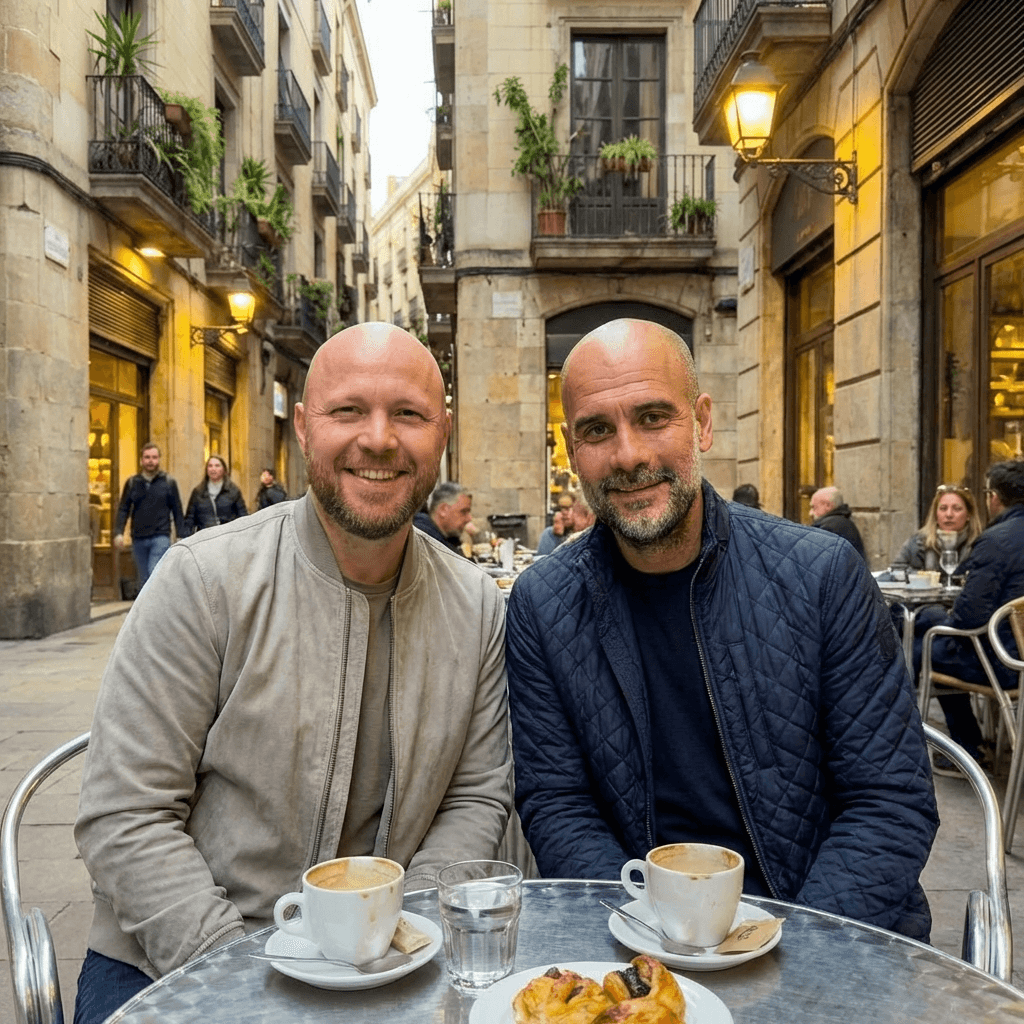

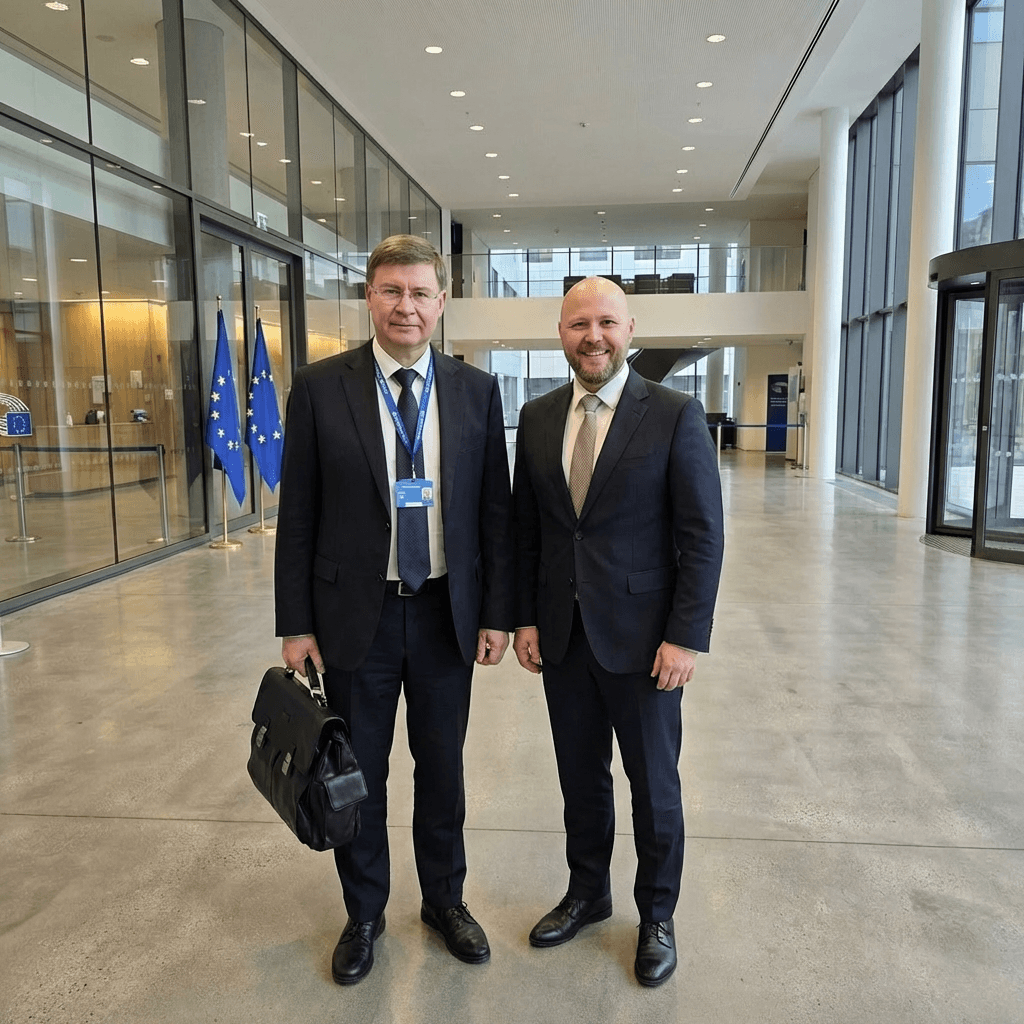

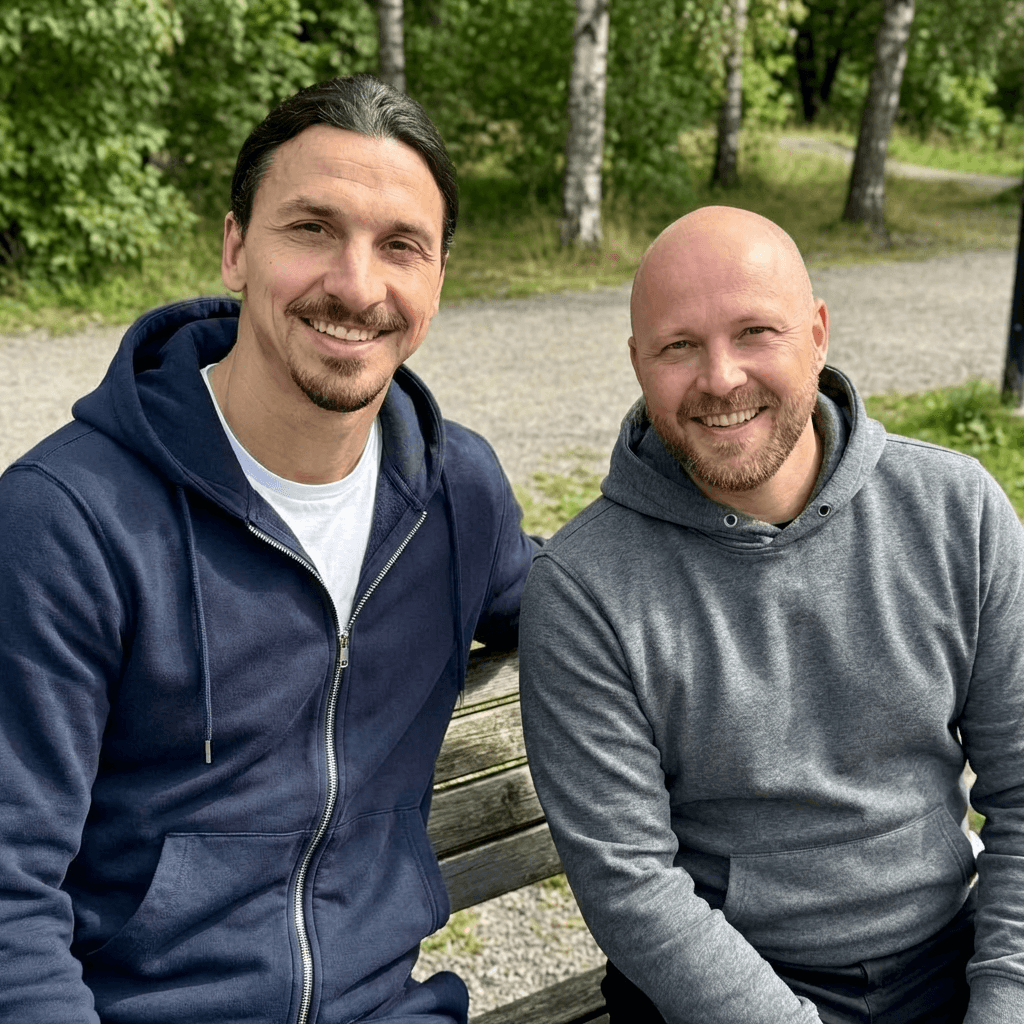

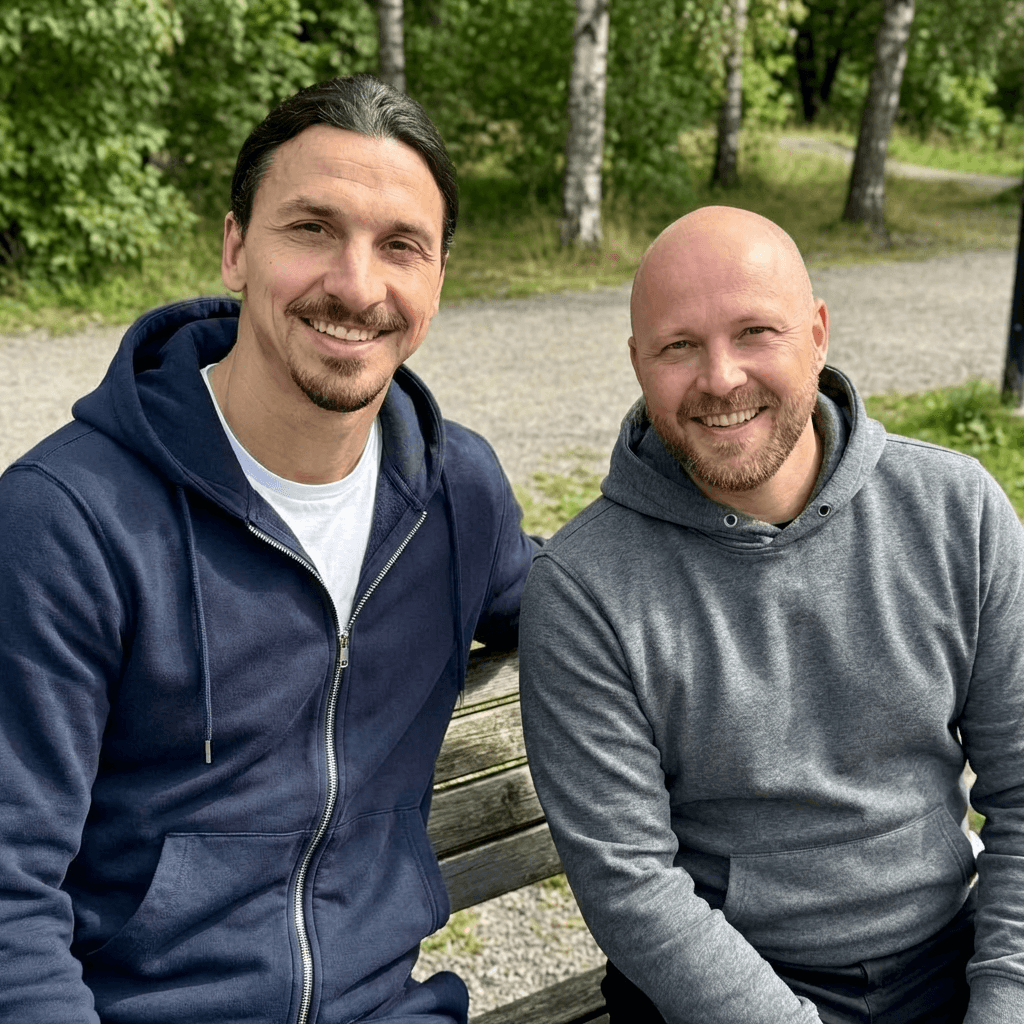

Selected rooms and stages I’ve shared

Niels B. Christiansen

CEO of LEGO

Gary Vee

Entrepreneur, author and marketing expert

Pep Guardiola

Spanish football manager, multiple trophies

Valdis Dombrovskis

European Commission Executive Vice‑President

Zlatan Ibrahimović

Swedish footballer, prolific goal scorer

Zlatan Ibrahimović

Swedish footballer, prolific goal scorer

I’ve been fortunate to share rooms and stages with people operating at the highest level in business, sport and entertainment. I’m more interested in what I learn from them than in the photo itself.

Selected rooms and stages I’ve shared

How I Show Up

I don’t buy companies like a fund manager. I buy them like someone who has to make them work.

0-001

rutuyt4uh

rutuyt4uh

0-001

Operator first

text

I don’t buy companies like a fund manager. I buy them like someone who has to make them work.

0-002

Partnership mindset

I look for alignment, not quick wins. If we work together, I want you to feel proud of the decision five years from now.

0-003

Quiet process

text

No press releases, no drama. Just serious work handled with discretion.

0-004

AI as an edge

text

I use AI like infrastructure, not marketing. Automation that increases margin, clarity and control.

0-001

rutuyt4uh

rutuyt4uh

How I Show Up

I don’t buy companies like a fund manager. I buy them like someone who has to make them work.

0-001

rutuyt4uh

rutuyt4uh

0-001

Operator first

text

I don’t buy companies like a fund manager. I buy them like someone who has to make them work.

0-002

Partnership mindset

I look for alignment, not quick wins. If we work together, I want you to feel proud of the decision five years from now.

0-003

Quiet process

text

No press releases, no drama. Just serious work handled with discretion.

0-004

AI as an edge

text

I use AI like infrastructure, not marketing. Automation that increases margin, clarity and control.

0-001

rutuyt4uh

rutuyt4uh

How I Show Up

I don’t buy companies like a fund manager. I buy them like someone who has to make them work.

0-001

rutuyt4uh

rutuyt4uh

0-001

Operator first

text

I don’t buy companies like a fund manager. I buy them like someone who has to make them work.

0-002

Partnership mindset

I look for alignment, not quick wins. If we work together, I want you to feel proud of the decision five years from now.

0-003

Quiet process

text

No press releases, no drama. Just serious work handled with discretion.

0-004

AI as an edge

text

I use AI like infrastructure, not marketing. Automation that increases margin, clarity and control.

0-001

rutuyt4uh

rutuyt4uh

If you’re reading this, you’re probably one of them

Maybe you’re quietly thinking about selling, but don’t want the market – or your team – to know yet. Maybe you’re wondering what your company is really worth to someone who understands how it works. Maybe you just want to talk to a buyer who has carried the weight you’re carrying.

Send a short message about your business and where you are today. Everything stays between us.

Your message goes directly to me. It isn’t shared with anyone else.

Replies Faster Than Most Lawyers

Replies Faster Than Most Lawyers

Confidential By Default

Confidential By Default

Skin in the Game, Not Just Slides

Skin in the Game, Not Just Slides

ARIS JANSONS

ARIS JANSONS

ARIS JANSONS

aj@jansso.com

aj@jansso.com

aj@jansso.com

Europe